When the European Parliament announced that political agreement on the EU Green Bond Regulation (the Regulation) had been reached with the Council on 28 February 2023, rapporteur Paul Tang was quoted as saying:

« This Regulation creates a gold standard that green bonds can aspire to. It ensures that the money raised must go to green activities and that bonds are vetted by professional and independent third party reviewers. This is a world apart from current market standards. »

Now that the consolidated text is available and the European Parliament’s plenary vote is expected to take place in the autumn with application 12 months after publication in the Official Journal, is the gold standard European green bond or EuGB label really a world apart from the current market approach?

The key is that the gold standard EuGB label is voluntary. However, an issuer wanting to use the label for a green use of proceeds bond will need to: (i) comply with the allocation requirements; (ii) provide pre- and post-issuance disclosure; (iii) have that disclosure externally reviewed; and (iv) be willing to submit to the oversight of the competent authority of its home Member State under the EU Prospectus Regulation (PR). An issuer does have alternatives. It has the option under the Regulation to provide sustainability disclosures for (i) use of proceeds bonds not using the label but marketed as environmentally sustainable or (ii) sustainability-linked bonds, although competent authority supervision will still apply in this case. Importantly, an issuer will also still be able to continue to follow the ICMA Principles instead, should they prefer.

It is worth noting that in December 2022, the European Commission published proposed amendments to the PR as part of its Listing Act package, which suggested amendments to the delegated act powers in the PR to allow the Commission to adopt a disclosure annex to be followed for prospectuses prepared in relation to ESG securities. The content of any such disclosure annex and the extent to which it might follow any of the disclosures required for a bond using the EuGB label, or the alternative optional disclosures regime under the Regulation, for issuers of bonds marketed as environmentally sustainable is not yet known.

European green bonds (EuGB label bonds)

To use the label an issuer will need a PR compliant prospectus or be an exempt EU Sovereign issuer. It remains to be seen whether green bond issuers currently listed elsewhere, including on exchange regulated markets, will want to draw up a prospectus in order to use the EuGB label and whether that will drive a move onto regulated markets.

The prospectus will need to specifically designate the bonds as European green bonds or EuGB and the use of proceeds section will need to include a statement that the bonds are issued in accordance with the Regulation.

Allocation of proceeds

The distinction from the current market approach begins with the prescriptive requirements in relation to allocation of proceeds. Before the maturity of the European green bond, the proceeds (from which issuance costs can be deducted) need to have been fully allocated to fixed assets, capital expenditures, operating expenditures, financial assets or assets and expenditures of households according to the criteria set out in Article 3 of the EU Taxonomy Regulation (the Taxonomy) including:

- contributing substantially to one or more of the environmental objectives set out in Article 9 of the Taxonomy;

- doing no significant harm to any other environmental objectives;

- complying with minimum safeguards; and

- complying with technical screening criteria (TSC).

Alternatively, issuers could allocate proceeds from a portfolio of one or more outstanding European green bonds to a portfolio of fixed assets or financial assets (according to the Taxonomy requirements).

There are special requirements in relation to Sovereigns and also in relation to securitisations. For more information on these areas, please speak to your usual A&O contacts.

In addition, if capital expenditures or operating expenditures will meet the Taxonomy requirements in the future, an issuer will need to publish a CapEx plan specifying a deadline by when all expenditures funded by the European green bond shall be Taxonomy aligned (which must be before maturity). Crucially, a summary of the CapEx plan will need to be included in the prospectus, bringing with it potential prospectus liability.

Bond proceeds must be allocated in alignment with TSC applicable at the time the bond is issued. The Regulation does, however, introduce some flexibility. Up to 15 per cent. of the proceeds can be allocated to activities that comply with the Taxonomy requirements, with the exception of the TSC, where there are no relevant TSC in force on issue, as long as the activities “Do No Significant Harm” to any other environmental objectives.

If the TSC are amended after issuance, (i) proceeds that are not yet allocated or (ii) proceeds covered by a CapEx plan that have not yet met the Taxonomy requirements, will need to be allocated in alignment with the amended TSC within seven years after their entry into application. If proceeds covered by a CapEx plan are at risk of not being aligned, the issuer must publish and have reviewed a remediation plan for the purposes of aligning to the amended TSC.

If a portfolio approach is followed, only fixed assets and financial assets where the underlying economic activity is aligned with TSC which were applicable at some point during the seven years prior to the relevant allocation report can be included in the portfolio.

Disclosure

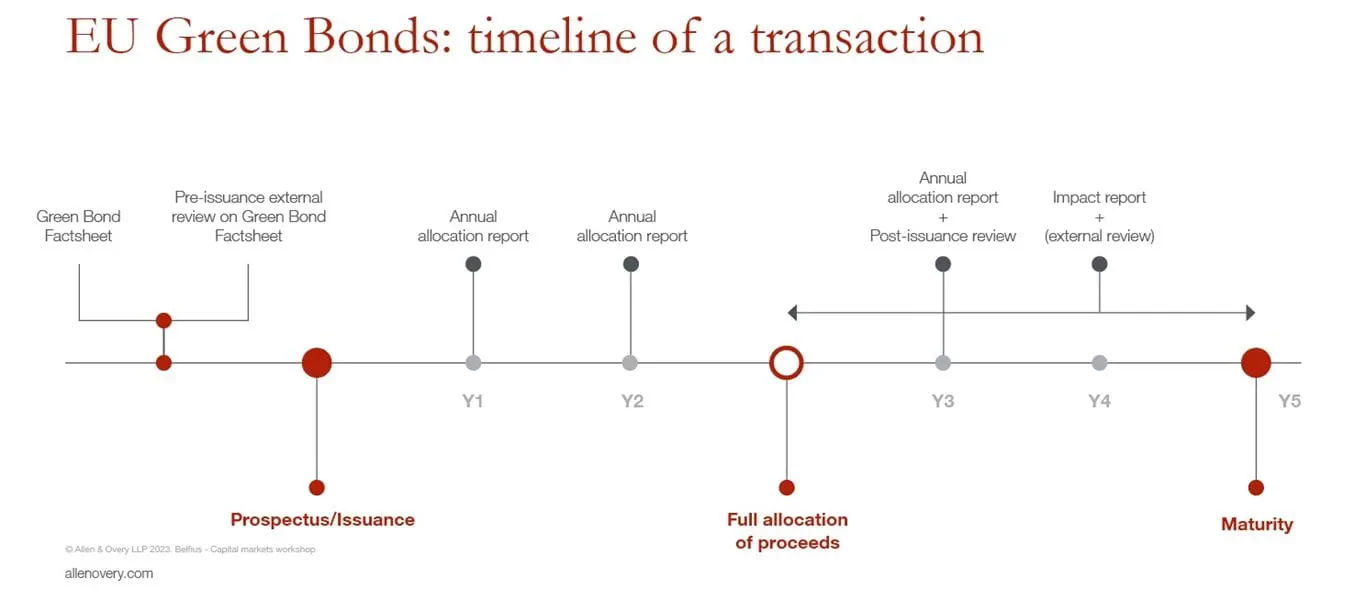

Another difference compared to the current market approach based on the ICMA principles is the disclosure required in addition to the prospectus, summarised in the timeline below.

The pre-issuance factsheet includes some forward looking requirements such as disclosure about how the bonds are expected to contribute to the broader environmental strategy of the issuer and (for companies that will be required to sustainability report under the Corporate Sustainability and Reporting Directive (CSRD)) how they are expected to contribute to the issuer’s Taxonomy aligned assets, turnover, capital expenditures and operating expenditure. The factsheet and external review of the factsheet will need to be published on the issuer’s website before the issuance of the bond and made available there until at least 12 months after the maturity of the bond, which could cause issuers some timing concerns before the launch of a transaction, especially for trades under a programme.

The factsheet will count as regulated information for the purposes of the PR and so could be incorporated by reference into the prospectus. If not incorporated by reference or summarised in the prospectus, an issuer will need to be comfortable that the information contained is not necessary for an investment decision.

External Reviews

In addition, although the ICMA Principles recommend external reviews of the framework and bond alignment with it, the Regulation requires external reviews of the pre-issuance factsheet and allocation report after full allocation of proceeds. It also introduces a requirement that external reviewers of European green bonds will need to register with ESMA and comply with certain conditions set out in the Regulation. It provides a regime for third country external reviewers (of registration, recognition and endorsement) and transitional provisions, which will be in play for 18 months following entry into application of the Regulation.

Competent Authority oversight

All of these disclosure documents, i.e. the factsheet and associated external review, the allocation reports (and reviews), CapEx plans, impact report (and any external review), as well as a link to the prospectus and any amendments to these documents will need to be published on the issuer’s website until at least 12 months after maturity of the bonds. Issuers will also need to inform the competent authority of their PR home Member State and ESMA of the publication of these documents. The competent authority of the home Member State will have supervisory powers over compliance with provisions around the factsheet, the allocation reports and the impact report. These include power to suspend trading in the EuGB label bonds and there may be a concern that a failure to meet the disclosure requirements may risk imposition of such measures, although it isn’t yet clear exactly how the supervision will be conducted.

Optional disclosures for issuers of bonds marketed as environmentally sustainable or sustainability-linked bonds

The consolidated text provides an alternative, optional regime of pre and post issuance disclosures for bonds marketed as environmentally sustainable in the Union and sustainability-linked bonds (SLBs). This is an improvement on the previous Parliament version, which required mandatory disclosures for bonds marketed in the Union as environmentally sustainable. However, the rapporteur Paul Tang has said that this is for issuers “that are keen to show they are serious about their green claims but not yet able to adhere to the strict standards of the gold standard. With a clear system for disclosures, any green bonds not using this system, will likely be looked at with increasing suspicion.”

The Commission will be mandated to publish guidelines and adopt delegated acts with a view to establishing content, methodologies and presentation, as well as voluntary templates, for these disclosures. If an issuer chooses to disclose post-issuance information, the competent authority of its PR home Member State shall supervise the post-issuance disclosure it makes. Having said that, in the current consolidated text the pre-issuance disclosure doesn’t appear to be subject to supervision and a PR compliant prospectus will not necessarily have been prepared so it is not yet clear how PR home Member State supervision is intended to operate.

The future?

It remains to be seen how many issuers adopt the label given the concerns around the usability of the Taxonomy and the requirements of the Regulation over and above current market practice. It may be that, EU sovereigns, supranationals and agencies, together with pure-play green companies, are the first to use the label. However, the label may become increasingly popular as more issuers get used to the growing environment of sustainability reporting.

The review clause states that the Commission will draft a report within five years, assessing among other things, the uptake of the EUGB label and of the optional pre- and post-issuance disclosure regime. Such report will be accompanied, where appropriate, with a legislative proposal including as regards these optional disclosures. There is also a mandate for the Commission to publish a report within three years on the need to regulate SLBs. The direction of travel could be that, unless there is sufficient uptake, mandatory requirements may follow.